The Great Depression and The new Deal

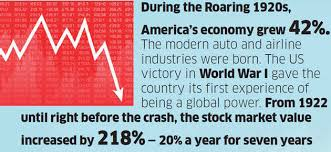

CONTEXTUALISATION

I) Harbinger of crisis : Economic weaknesses of the 1920s

President Herbert Hoover expressed his wish to end poverty in the US. This did not seem an outlandish goal. Some observers noted some increasingly worrisome economic trends that could provoke greater problems.

1. Agricultural prices. The end of the WWI brought a collapse in the price of agricultural goods led to the failure and foreclosure of many farms. Congress passed legislation to provide support to farmers but twice president COOLIDGE vetoed.

2. Buying on the installment plan. The consumer buying spree of the 1920s was in large part made possible by the availability of easy credit. Most Americans could not afford to buy their automobiles, refrigerators, radios and many products with a lump-sum payment. Instead the purchased these goods installments, making monthly payments. By 1928 et 1929, many people were tied up paying for products they already possessed. They didn’t have money to buy more things. Factories continued to produce consumers goods, but inventories of unpurchased goods grew. Some industries were cutting back on their workforces in 1928.

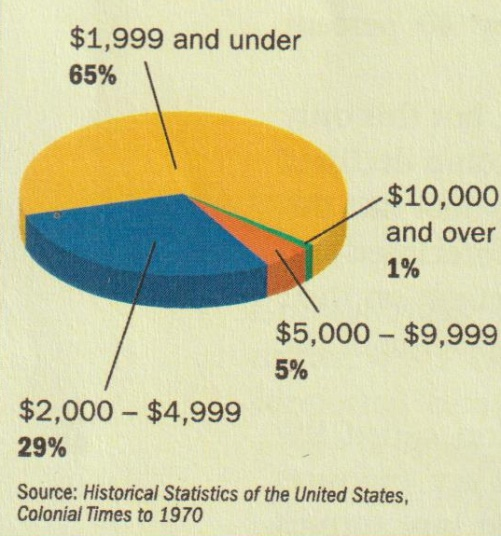

3. The gap in the distribution of wealth. Americans generally prospered in the 1920s but by 1929, 0.02 % of the American population possessed more than 40% of the nation’s savings. At the same time, three quarters of American families earned less than 3000 $ a year. In 1029, most Americans were no longer in a position to sustain the decade consumer binge. Affluent Americans could not sustain the economy on their own.

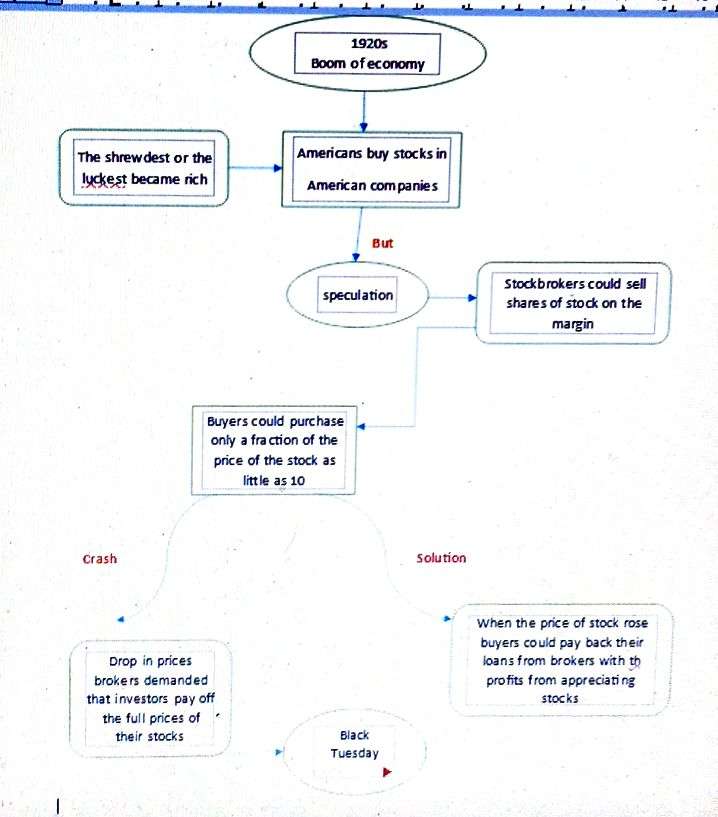

II) A stock market out of control

III) The black tuesday and the end of the speculation

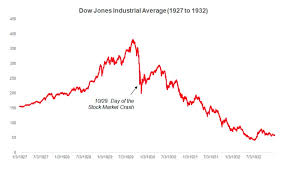

The highest point of the Bull Market came in September 1929. From September to the end of October, stock prices began a slowdown. Investors remarked that some factories laid off workers because of unsold inventor.

On Wednesday October 23 the shares of stock fell around 26 points. It may lead to panic a spontaneous and uncontrolled movement where a wave of selling provoked a dramatic drop in stock prices. President Hoover declared into a speech that the economy were “on a sound and prosperous basis”. But the slide of share values didn’t stop. The black Tuesday October 29, the market collapsed with prices falling by 40 points. The fact was that the folly of buying on the margin was became obvious and dangerous. But the legend which said the investors suicided at the top of the building was false but epitomized that man investors had suffered heavy financial losses.

Analyzing political cartoons

After the apparent prosperity of the 1920s, virtually few were prepared for the devasting effects of the stock market crash. This cartoon by James N. Rosenberg, which shows Wall Street crumbling on October 29, 1929, is titled Dies Irae, Latin for “day of wrath”.

Questions

1.Why did the artist title a political cartoon about October 29, 1929 « Day of wrath » ?

2.What does the cartoonist suggest will happen to individuals because of the crash?

3.How does the cartoonist convey the sense of fear and shock?

4.What do the looks on the people’s faces indicate about the impact of the crash?

5.What message is Rosenberg trying to convey about the events of October 29, 1929 ? Do you agree with his statement ? Why or why not ?

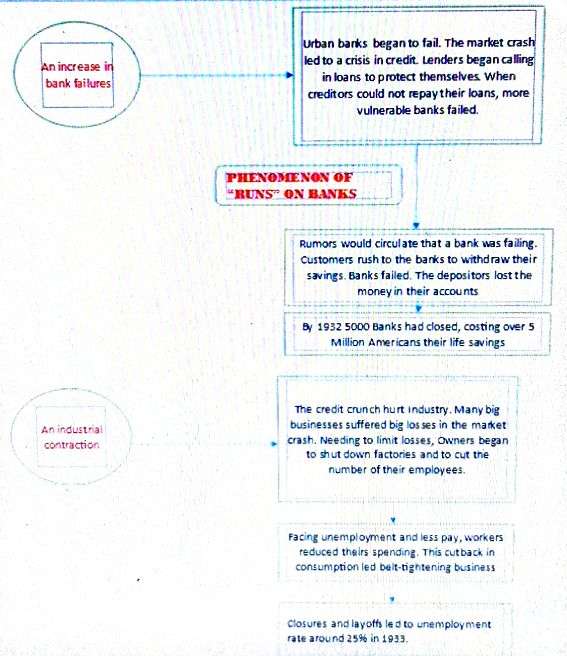

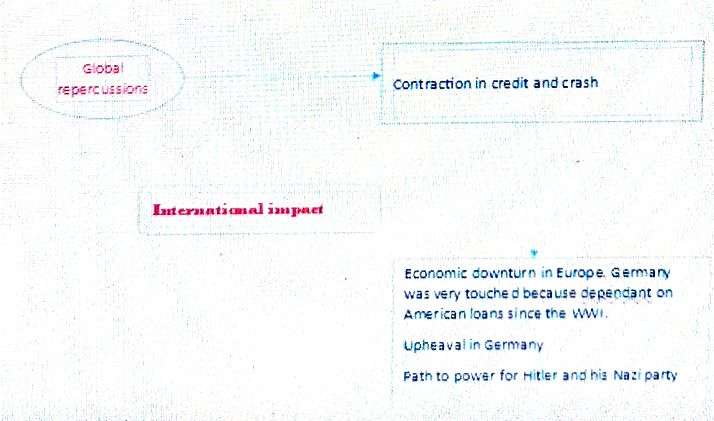

IV) The stock market Crash and The Great Depression

After the crash, President Hoover specified that the American economy was globally and fundamentally sound. He reminded his fellow citizens that the economy was much more than a volatile stock market that traditionally went up and down. Indeed, the stock market crash did prove to be a boost of the Great Depression for the following reasons :

Remarks :

What happened in 1929? And after?

Compare 1929 AND Covid period.

UNEVEN INCOME DISTRIBUTION, 1929

the 1920s were an era that favored big business. Life was good for the rich. They made up just 0.1 percent of the population and had yearly incomes of $100000. Conversely, much of the population had to scape to get by. Many earned so little that everyone in the family, including children, hat to work. Nearly 80 percent of all families had no savings.

What do the document deal with?

What do you notice?

Could the document explain the stock market frenzy?

Has the situation changed since this time ?

V) The Great Depression and the American Society

Hourly workers and white-collar professionals lost their jobs in first. Many other Americans were underemployed. Women workers were fired to protect the jobs of male family breadwinners. Bosses were forced to make hard choices. In an other hand, large numbers of me suffered from mental depression because they were in a position to satisfy his family’s needs. So, a lot of men took jobs from women, minorities or teenagers. The 1930s were hard and disorienting time for many Americans.

At the beginning of 1930, private and local groups attempt to meet the needs of the unemployed and homeless with shelters and soup kitchens. Some families lost their homes began living in encampments on the outskirts of cities where they constructed ramshackle dwellings out of scraps of wood, metal and cardboard. Hoovervilles were the name of these settlements because of the President was considered the first responsible.

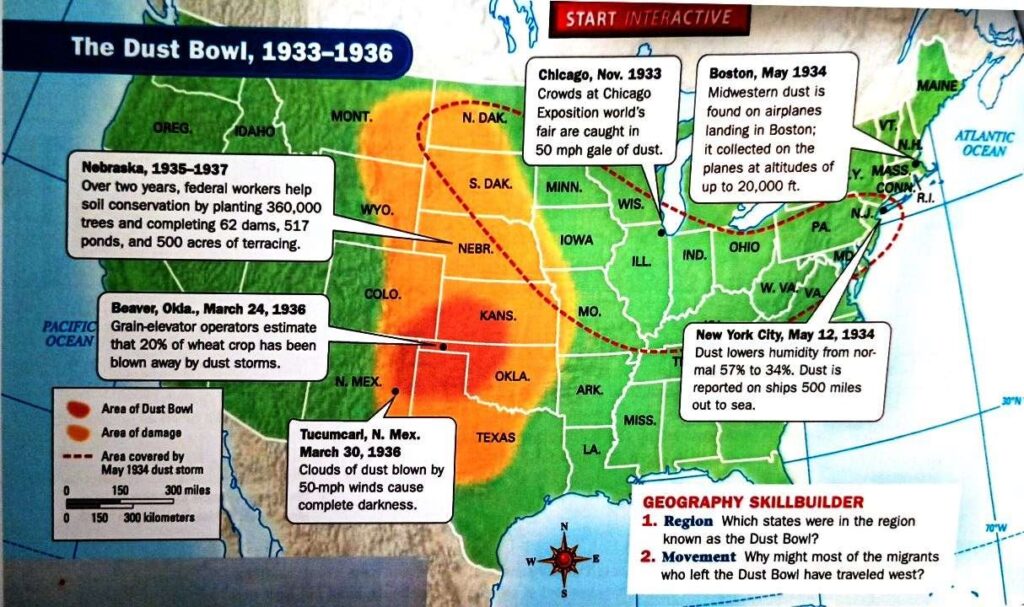

An extended drought aggravated erosion problems brought on by poor soil conservation practices in the states of Oklahoma, Kansas, Nebraska, Colorado and Texas. Enormous dust storms ravaged the region during the 1930S. Sixty percent of the farms had been devastated. Many inhabitants immigrated to California. They hoped to rebuild their lives by finding work in this rich state. Steinbeck described the travails of these people in the GRAPES OF WRATH (1939).

The people who lived through the Great Depression developed habits of mind. In 1940s, a lot of Americans refused to buy on credit, preferring to purchase automobiles and other products with lump-sum cash payments.

The people who lived through the Great Depression developed habits of mind. In 1940s, a lot of Americans refused to buy on credit, preferring to purchase automobiles and other products with lump-sum cash payments.